October 20th, 2011 by John Di Saia, M.D. in Opinion

1 Comment »

In years gone by, I spent far too much time removing small skin bumps in the office. At the time, I was sharing space with another doctor who was profiting by any service I provided. His staff scheduled me with tons of things that simply made me no money. [Meanwhile his stuff diverted some of my better business into his schedule as opposed to mine.]

The facts of life are that medicine is a business and when I am paying a huge chunk of change to overhead, I need to make that back or I operate at a loss.

Patients frequently don’t understand why I cannot remove their moles for what their insurance pays and make a profit. Well, Read more »

*This blog post was originally published at Truth in Cosmetic Surgery*

October 20th, 2011 by PreparedPatient in Health Policy, True Stories

1 Comment »

A couple weeks ago I walked the streets of Lincoln, Nebraska, talking to men and women about whether they thought Washington was listening to their economic concerns. Jeff Melichar manages his family’s Phillips 66 gas station on the city’s main street, and one of his big financial problems happens to be health insurance. The more we talked, the more I realized what a jam he could be in down the road because of a loophole in the health reform law, which has received almost no press coverage or public discussion: If you have health insurance from your employer, you may have to keep it whether or not it’s adequate or affordable. Buying less expensive or better coverage from one of the state “exchanges” or shopping services will be off limits. So despite all that talk about consumer choice, for many like the Melichars, there may be no choice.

A couple weeks ago I walked the streets of Lincoln, Nebraska, talking to men and women about whether they thought Washington was listening to their economic concerns. Jeff Melichar manages his family’s Phillips 66 gas station on the city’s main street, and one of his big financial problems happens to be health insurance. The more we talked, the more I realized what a jam he could be in down the road because of a loophole in the health reform law, which has received almost no press coverage or public discussion: If you have health insurance from your employer, you may have to keep it whether or not it’s adequate or affordable. Buying less expensive or better coverage from one of the state “exchanges” or shopping services will be off limits. So despite all that talk about consumer choice, for many like the Melichars, there may be no choice.

Melichar’s wife is eligible for health insurance from the optical company where she works. But the family waited until this fall to enroll when the firm offered coverage they finally could afford. Their premium is Read more »

*This blog post was originally published at Prepared Patient Forum: What It Takes Blog*

October 11th, 2011 by DavedeBronkart in Health Policy, Opinion

No Comments »

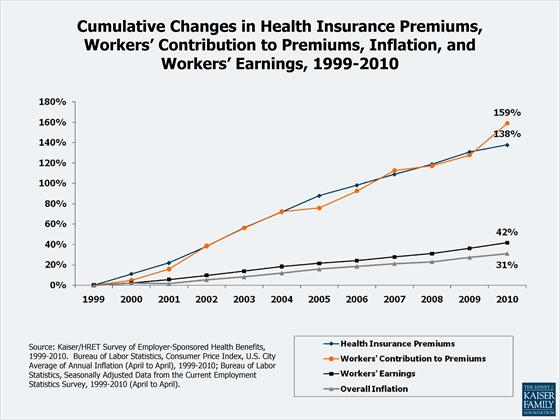

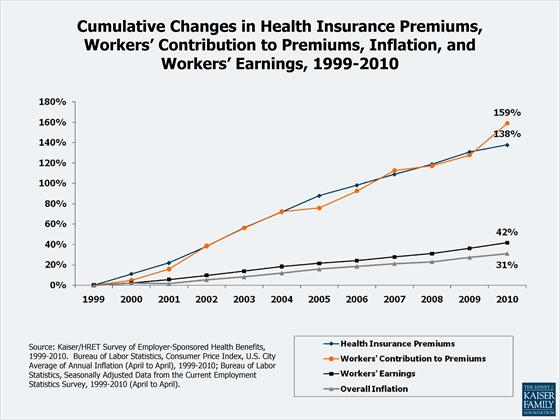

Last week the New York Times reported that some health insurers have applied to regulatory agencies to push premiums sharply higher – usually double-digit increases, while citizens are suffering. This falls on top of the 11 year history reported last year by the Kaiser Family Foundation: wages and inflation are up ~40%, while health costs and worker contributions were up 138% and 159%:

No wonder we feel squeezed. (Last week’s announcement comes on top of this history.)

This has enormous human impact. Read more »

*This blog post was originally published at e-Patients.net*

October 7th, 2011 by BobDoherty in Health Policy, News

No Comments »

Last week, Medicare’s Center for Medicare and Medicaid Innovation announced a Comprehensive Primary Care (CPC) Initiative, which asks private payers and state Medicaid programs to join with Medicare to “help doctors work with patients to ensure they:

1. Manage Care for Patients with High Health Care Needs;

2. Ensure Access to Care;

3. Deliver Preventive Care;

4. Engage Patients and Caregivers; and,

5. Coordinate Care Across the Medical Neighborhood,”

according to an email from CMS’s press office. The initiative will provide qualified practices with risk-adjusted, per patient per month care managements payments, in addition to traditional fee-for-service payments, along with the opportunity to share in savings achieved at the community level.

I believe that the Initiative is a potential game-changer in helping to support and sustain primary care in the United States. But Read more »

*This blog post was originally published at The ACP Advocate Blog by Bob Doherty*

October 1st, 2011 by PreparedPatient in News, Opinion

No Comments »

Cigna launched a $25 million “GO YOU” national branding campaign last week signaling that they are gearing up for tons of new customers as health reform rolls towards 2014. That new business will come from the millions of Americans now uninsured who will start getting government subsidies as an encouragement to buy health insurance coverage. If those uninsured folks don’t get coverage, they will have tax penalties to pay.

Cigna launched a $25 million “GO YOU” national branding campaign last week signaling that they are gearing up for tons of new customers as health reform rolls towards 2014. That new business will come from the millions of Americans now uninsured who will start getting government subsidies as an encouragement to buy health insurance coverage. If those uninsured folks don’t get coverage, they will have tax penalties to pay.

No insurer wants to be left behind in this expanding marketplace, so Cigna, by being first out of the gate, hopes to build brand awareness that will ring bells in 2014 when consumers must buy insurance. It’s a smart strategy. One industry consultant says “most insurers have not built enough brand equity with consumers.”

Cigna’s ad campaign positions health insurance as Read more »

*This blog post was originally published at Prepared Patient Forum: What It Takes Blog*

A couple weeks ago I walked the streets of Lincoln, Nebraska, talking to men and women about whether they thought Washington was listening to their economic concerns. Jeff Melichar manages his family’s Phillips 66 gas station on the city’s main street, and one of his big financial problems happens to be health insurance. The more we talked, the more I realized what a jam he could be in down the road because of

A couple weeks ago I walked the streets of Lincoln, Nebraska, talking to men and women about whether they thought Washington was listening to their economic concerns. Jeff Melichar manages his family’s Phillips 66 gas station on the city’s main street, and one of his big financial problems happens to be health insurance. The more we talked, the more I realized what a jam he could be in down the road because of