March 17th, 2010 by Debra Gordon in Better Health Network, Opinion

1 Comment »

Gather round boys and girls. Today’s lesson is on “risk pools.”

Gather round boys and girls. Today’s lesson is on “risk pools.”

Before you pull out your iPhone to ward off the boredom you assume will come, know this: the concept of risk pools is at the heart of today’s healthcare reform debate.

To understand risk pools, you first have to understand the basic concept of insurance. Insurance is something you buy in case something happens. The more people buying the same type of insurance, the less risk the insurer faces that it will have to pay out for that aforementioned “something.” Read more »

*This blog post was originally published at A Medical Writer's Musings on Medicine and Health Care*

February 22nd, 2010 by Stanley Feld, M.D. in Better Health Network, Health Policy, Opinion

No Comments »

Ann Braly, WellPoint’s CEO, launched a new offensive to protect the vested interests of the healthcare insurance industry now that Obamacare seems to be dead.

The healthcare insurance offensive began with her op-ed article in the Wall Street journal on February 7, 2010. Readers will have a deeper understanding of the offensive if they follow the underlined historical links in this article.

It will destroy President Obama’s credibility, the practice of medicine, patient access to care and increase the number of uninsured. It will bankrupt the country if her offensive is successful.

The healthcare insurance industry is killing the goose that laid its golden egg.

Read more »

*This blog post was originally published at Repairing the Healthcare System*

September 29th, 2009 by EvanFalchukJD in Better Health Network, Health Policy

No Comments »

Joe Biden unveiled a White House study on the rise of health insurance premiums. He pressed for consumer protections the President wants to see in any reform legislation. Among these are a pledge to pass a law that “ends exorbitant out-of-pocket expenses, deductibles or co-pays.” Presumably this is meant to address worries many feel over the growth of high-deductible health plans.

The St. Petersburg Times looked into it to find out what this pledge means, in practical terms. David Axelrod at the White House pointed them to the proposed House legislation, which would create limits on out-of-pocket expenses, deductibles and co-pays of $5,000 a year for an individual, and $10,000 a year for a family.

Read more »

*This blog post was originally published at See First Blog*

September 7th, 2009 by Happy Hospitalist in Better Health Network, Health Policy

No Comments »

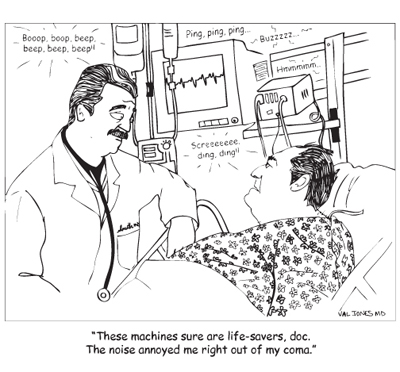

The time has come to change the rules. As you know the current insurance market is unsustainable. Whether you’re talking about The Medicare National Bank or your Blue Cross, they are all doomed for failure. Why? Because they treat everyone (group plans) the same . And as a result, the incentive towards health has been lost.

What if it wasn’t like that? What if your cost of insurance was 1/10 as much? What if you only paid $1000 a year in insurance, and carried an income based high deductible health policy? What if you were required to take care of the oil changes while your insurance, an affordable insurance, was there to protect you from disaster. An insurance you bought in the open market.

Is all this possible in the current insurance market? Not even close. If you are lucky enough to be employed by a big corporation, you are lucky enough to have deep premium discounts and a large population to spread the risk. If you work for a small business or are a small businessman, you are just one major illness away from catastrophic premium increases. Should you or one of your employees get sick, you’re all screwed.

If three of Happy’s hospitalists suddenly became gravely ill with H1N1 and were left on the ventilator for weeks and accrued hundreds of thousands, perhaps millions of dollars of health care bills, the cost of my premiums would rise dramatically, as a consequence of the large risk in a small pool of people, Happy’s private hospitalist group. While big business is able to spread that risk over hundreds, sometimes thousands of employees, they too are finding that they can’t keep up with the cost of health care inflation.

Why? Why does it have to be so difficult? When people are put in control of their health care dollars, they have a skin in the game that can’t be appreciated by the third party insurance model. Few people realize that the $12,000 in premiums their employer is paying, on their behalf, is $12,000 that is coming out of their pocket.

Many liberals want to claim that middle class wages were stagnant during the Bush years. Hardly, when you account for the health care premiums their employers paid on their behalf, the numbers don’t look so bad. These are stealth wages, wages which might as well be cash in your pocket.

Unfortunately, the current rules of the land have created a completely irrational playing field. Why should my choices be limited to what my employer offers or what my state says is right for me? Why should I be straddled with massive rises in insurance premiums because three of Happy’s partners had an unlucky run in with a virus? It shouldn’t have to be that way.

That’s why I see market choice and responsibility as the way out of this fiscal disaster. If premiums have doubled in the last 10 years to $12,000, how many businesses big and small can afford $25,000 in ten more years? The answer is almost none. Obama’s proposals do nothing to address this factor. The solution is not more insurance. The solution is not Universal insurance. The solution is to change the rules of the game. Rules your government created. Rules which brought us where we are today. The current insurance model does not work because our insurance has become an inflated currency of trade. A currency which is not allowed to follow the rules of supply and demand. Look only to the expansion of health care jobs in the worst recession in over 50 years and ask yourself how that is possible. And ask yourself if that is sustainable.

I do not want to be paying $25,000 a year a decade from now. $25,000 a year for taking care of myself and doing what’s right for my body.

- Don’t smoke,

- Engage in 3 1/2 hours a week of exercise.

- Eat a diet high in fruits and vegetables and low in read meat

- Don’t become obese (BMI >30)

If you do these four lifestyle actions, your odds of falling ill with one of these top four life changing or life ending diseases is slashed by 80%. That is an amazing fact. To a major degree you have the ability to decide your destiny of health by the actions you choose.

That’s the insurance pool I want to be a part of. Read more »

*This blog post was originally published at A Happy Hospitalist*

July 7th, 2009 by Emergiblog in Better Health Network, True Stories

1 Comment »

Why shouldn’t we have to pay for our health care?

Why….we don’t have that sort of money!!! How dare you even suggest that we should pay!!!!

We manage to buy cigarettes. We manage to buy fast food. Often. We manage to get all the channels we want via cable or satellite television. Some of us even have satellite radio in our cars. And GPS. Our cell phones are really nice, but all that texting costs a pretty penny. We drop a few bucks at Starbucks every week without thinking twice.

And then we roll our eyes when we have to pay for….god forbid…..health care!

*****

Think I’m heartless? Think I’m an elitist?

Think I’m talking about the Medicare patients in my ER who bring in a super-sized number 8 from McDonalds for the entire family and hold out their right arm for a BP while they text rapidly with their left hand?

I could be.

But I’m not.

The patient rolling their eyes at having to pay was me.

*****

Yeah.

Me.

Showed up for a colonoscopy yesterday and the receptionist went over what would and would not be covered by my insurance.

My out-of-pocket payment would be $216.

And my first thought was “why the hell am I paying anything out of pocket for this? I have insurance!”

I was ticked.

*****

But why was I ticked?

Why shouldn’t I have to incur out-of-pocket expenses?

I have insurance. Good insurance. Insurance I don’t pay a single penny for. It’s a benefit I get from my employer for working 24 hours a week.

Did I think I was entitled to full coverage because I was insured?

Entitled?

Me?

*****

Isn’t that term used to describe some patients who get their health care for “free” through a public plan?

Well, I get my coverage for “free”, too, and god help me, the emotion I felt in that office yesterday was “entitlement”.

Now I understand.

And I won’t use that term again.

Ever.

*This blog post was originally published at Emergiblog*

Gather round boys and girls. Today’s lesson is on “risk pools.”

Gather round boys and girls. Today’s lesson is on “risk pools.”