September 16th, 2009 by DrWes in Better Health Network, Opinion

No Comments »

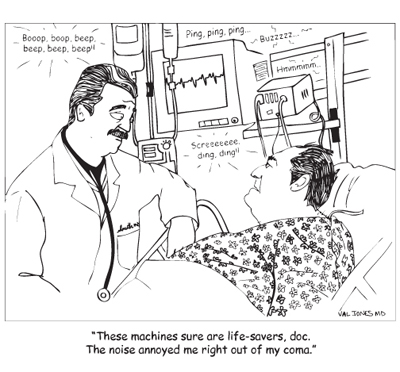

This week, like many doctors in primary care, I was sent a request by the Social Security to provide “medical evidence” that one of my patients was disabled so they could collect Social Security benefits. As part of that request, I was asked to provide evidence since June 6th, 2007, that my patient qualified for disability on the basis of “alleged” diagnosis of “Heart Disease.”

I was asked to send “copies of records or a narrative report including diagnosis, medical history, laboratory findings, treatment and response to treatment.” Beyond this, I also had to include physical and emotional impairment assessments and a functional assessment of their ability to sit, stand, walk, lift carry, handle objects, hear, speak, travel, and wash their car, view films, and eat bon bons (well, kind of).

And for this copying, writing, mailing, collating what might I see from the government to compensate my time? Well, if I attach this invoice that requires a Federal Employee Identification Number filed through form W-9 available at www.irs.gov (yes, Virginia, this compensation is taxed), I might receive…

…drum roll, please…

… twenty dollars.

Now looking up the lowest paygrade of Social Security worker’s annual compensation of $29,726 and accounting for the 13 vacation days, 13 paid sick leave days, and 10 federal holidays they get paid, I estimate the least expensive Social Security employee makes a bit more than $16.50 an hour.

If we assume that the paperwork they just asked for takes about 2 hours collectively of office staff and doctor time, I think it’s clear that doctors’ payment for this service provided on behalf of our patients is substantially less than what the Social Security administration pays their own staff.

I wonder what else the government has in store for us.

-Wes

*This blog post was originally published at Dr. Wes*

July 5th, 2009 by Happy Hospitalist in Better Health Network, Health Policy

No Comments »

Out of the Federal Reserve Bank of Dallas, comes this excellent presentation by its President and CEO, Richard Fisher about the fiscal disaster we currently find ourselves living in. Found (Via Grand Rants)

Out of the Federal Reserve Bank of Dallas, comes this excellent presentation by its President and CEO, Richard Fisher about the fiscal disaster we currently find ourselves living in. Found (Via Grand Rants)

Happy’s summary. We are all screwed. Every last one of us. Unless a massive shift of policy is instituted today, we leave no future for ourselves or our children. The entitlements we currently support are ponzi schemes a thousand times larger than Madoff and his thieves.

Tonight, I want to talk about a different matter. In keeping with Bill Martin’s advice, I have been scanning the horizon for danger signals even as we continue working to recover from the recent turmoil. In the distance, I see a frightful storm brewing in the form of untethered government debt. I choose the words—“frightful storm”—deliberately to avoid hyperbole. Unless we take steps to deal with it, the long-term fiscal situation of the federal government will be unimaginably more devastating to our economic prosperity than the subprime debacle and the recent debauching of credit markets that we are now working so hard to correct.

Stating the obvious, we are screwed. But how is Social Security you ask?

Now, fast forward 70 or so years and ask this question: What is the mathematical predicament of Social Security today? Answer: The amount of money the Social Security system would need today to cover all unfunded liabilities from now on—what fiscal economists call the “infinite horizon discounted value” of what has already been promised recipients but has no funding mechanism currently in place—is $13.6 trillion, an amount slightly less than the annual gross domestic product of the United States.

Sounds like a lot of money, but that’s the good news. Read on:

The good news is this Social Security shortfall might be manageable. While the issues regarding Social Security reform are complex, it is at least possible to imagine how Congress might find, within a $14 trillion economy, ways to wrestle with a $13 trillion unfunded liability. The bad news is that Social Security is the lesser of our entitlement worries. It is but the tip of the unfunded liability iceberg. The much bigger concern is Medicare, a program established in 1965, the same prosperous year that Bill Martin cautioned his Columbia University audience to be wary of complacency and storms on the horizon.

You should be afraid, very afraid of where we are heading.

Please sit tight while I walk you through the math of Medicare. As you may know, the program comes in three parts: Medicare Part A, which covers hospital stays; Medicare B, which covers doctor visits; and Medicare D, the drug benefit that went into effect just 29 months ago. The infinite-horizon present discounted value of the unfunded liability for Medicare A is $34.4 trillion. The unfunded liability of Medicare B is an additional $34 trillion. The shortfall for Medicare D adds another $17.2 trillion. The total? If you wanted to cover the unfunded liability of all three programs today, you would be stuck with an $85.6 trillion bill. That is more than six times as large as the bill for Social Security. It is more than six times the annual output of the entire U.S. economy.

And how much is that for you and me?

Let’s say you and I and Bruce Ericson and every U.S. citizen who is alive today decided to fully address this unfunded liability through lump-sum payments from our own pocketbooks, so that all of us and all future generations could be secure in the knowledge that we and they would receive promised benefits in perpetuity. How much would we have to pay if we split the tab? Again, the math is painful. With a total population of 304 million, from infants to the elderly, the per-person payment to the federal treasury would come to $330,000. This comes to $1.3 million per family of four—over 25 times the average household’s income.

What would you have to do to get the unfunded mandates funded?

- Either increase federal tax revenue 68% starting today, and continue it forever. Good luck with that. When you tax something, anything, you will get less of it. Nobody knows what tax rate could support that without destroying the economy in the process.

- Or cut discretionary spending 97% (that includes defense, education, environment and everything else under the sun), forever.

The issue isn’t not enough taxes. The issue is a government that cannot say no to its constituents. Now, I know some of you view Obama as your messiah, but I’m sure even he knows he can’t generate 99 trillion dollars on the backs of the rich. So the question is, does he have the guts to tell you no before it’s too late? It takes a real leader to tell his followers no. Right now, our leaders are promising everything and they will ultimately be able to deliver on nothing.

*This blog post was originally published at A Happy Hospitalist*